Quick ratio

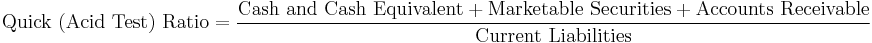

In finance, the Acid-test or quick ratio or liquid ratio measures the ability of a company to use its near cash or quick assets to extinguish or retire its current liabilities immediately. Quick assets include those current assets that presumably can be quickly converted to cash at close to their book values. A company with a Quick Ratio of less than 1 can not currently pay back its current liabilities.

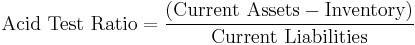

Note that Inventory is excluded from the sum of assets financially. Ratio are financially viable option for business entities but the liquidity of the liabilities show financial stability. Generally, the acid test ratio should be 1:1 or higher, however this varies widely by industry. [1] In general, the higher the ratio, the greater the company's liquidity (i.e., the better able to meet current obligations using liquid assets).[2]

Notice that very often Acid test refers instead of Quick ratio to Cash ratio:

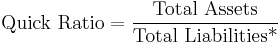

There is also another Quick Ratio which is widely used and computed as below

- Total Liabilities excludes Share Capital and Retained Earnings